Our everyday current account with no monthly fee

Money Confidence tools

Money Confidence tools

Money Confidence tools

Please make sure you have your documents ready. The application will take around 15 minutes.

You must be 18 or over and a UK resident to apply.

If you are a Spend & Save customer you can upgrade to Spend & Save Plus by logging into your account. If you can’t find the answer you’re looking for, come and visit us in branch.

To change to a Spend & Save account:

Adobe is a separate data controller from TSB, and any personal data you provide will be sent to Adobe and processed in agreement with their terms and conditions of service. You may wish to read their Adobe Terms of Use and Consumer Disclosure before using the link above.

Get offers from top brands like Vue, The Body Shop and lastminute.com plus essentials at Halfords, Vision Express, Whirlpool and more. T&Cs apply.

Internet Banking

Pay bills, check balances, transfer money between accounts, set up and cancel standing orders, view and cancel Direct Debits and more.

Mobile Banking

Manage your money whenever you want, wherever you are. It’s easy to see all your accounts in one place, check balances and pay bills.

Telephone Banking

Our UK contact centres are just a phone call away. We also have a quick and easy automated service that lets you manage your money 24/7.

Your Visa debit card

Handy, secure and accepted worldwide. A TSB Visa debit card gives you the freedom to buy things or withdraw your money wherever and whenever you want.

Grace Period

If your account goes over its limit, our Grace Period means that you have until 10pm (UK Time) to pay in enough money to avoid any Overdraft interest you may incur that day.

Contactless

Shop up to £100 without entering a PIN with your TSB Visa debit card. You can also use Apple Pay or Google Pay to pay with your phone.

What if you need extra support?

There may be lots of different reasons you might need to bank with us differently. It could be because of your physical or mental wellbeing, or because of a life event you’ve experienced.

If you choose to tell us about your individual support needs, we will take the time to understand your circumstances and work with you to make sure you have the support you need when banking with TSB.

Perfect for short-term borrowing

If you need to borrow a small amount of money for a short period of time, an overdraft may be cheaper than a personal loan or credit card. Use our overdraft calculator for an estimate on costs of using your overdraft.

It's flexible

You’re in control of your overdraft. You can ask to increase, decrease or cancel it at any time.

Internet Banking

Pay bills, check balances, transfer money between accounts, set up and cancel standing orders, view and cancel Direct Debits and more.

Mobile Banking

Manage your money whenever you want, wherever you are. It’s easy to see all your accounts in one place, check balances and pay bills.

Telephone Banking

Our UK contact centres are just a phone call away. We also have a quick and easy automated service that lets you manage your money 24/7.

Your Visa debit card

Handy, secure and accepted worldwide. A TSB Visa debit card gives you the freedom to buy things or withdraw your money wherever and whenever you want.

Grace Period

If your account goes over its limit, our Grace Period means that you have until 10pm (UK Time) to pay in enough money to avoid any Overdraft interest you may incur that day.

Contactless

Shop up to £100 without entering a PIN with your TSB Visa debit card. You can also use Apple Pay or Google Pay to pay with your phone.

What if you need extra support?

There may be lots of different reasons you might need to bank with us differently. It could be because of your physical or mental wellbeing, or because of a life event you’ve experienced.

If you choose to tell us about your individual support needs, we will take the time to understand your circumstances and work with you to make sure you have the support you need when banking with TSB.

Perfect for short-term borrowing

If you need to borrow a small amount of money for a short period of time, an overdraft may be cheaper than a personal loan or credit card. Use our overdraft calculator for an estimate on costs of using your overdraft.

It's flexible

You’re in control of your overdraft. You can ask to increase, decrease or cancel it at any time.

We guarantee switching your bank account to us will only take seven working days.

It’s easy as 1-2-3.

Choose to switch to us when you apply, or any time after.

We will move all your incoming and outgoing payments into your new account.

In the unlikely event there are any hiccups, we'll refund any interest and charges on your old or new current accounts.

You can now:

This is all in addition to the usual stuff, like checking your balance and past transactions, making quick payments and transfers, and finding your nearest TSB branches.

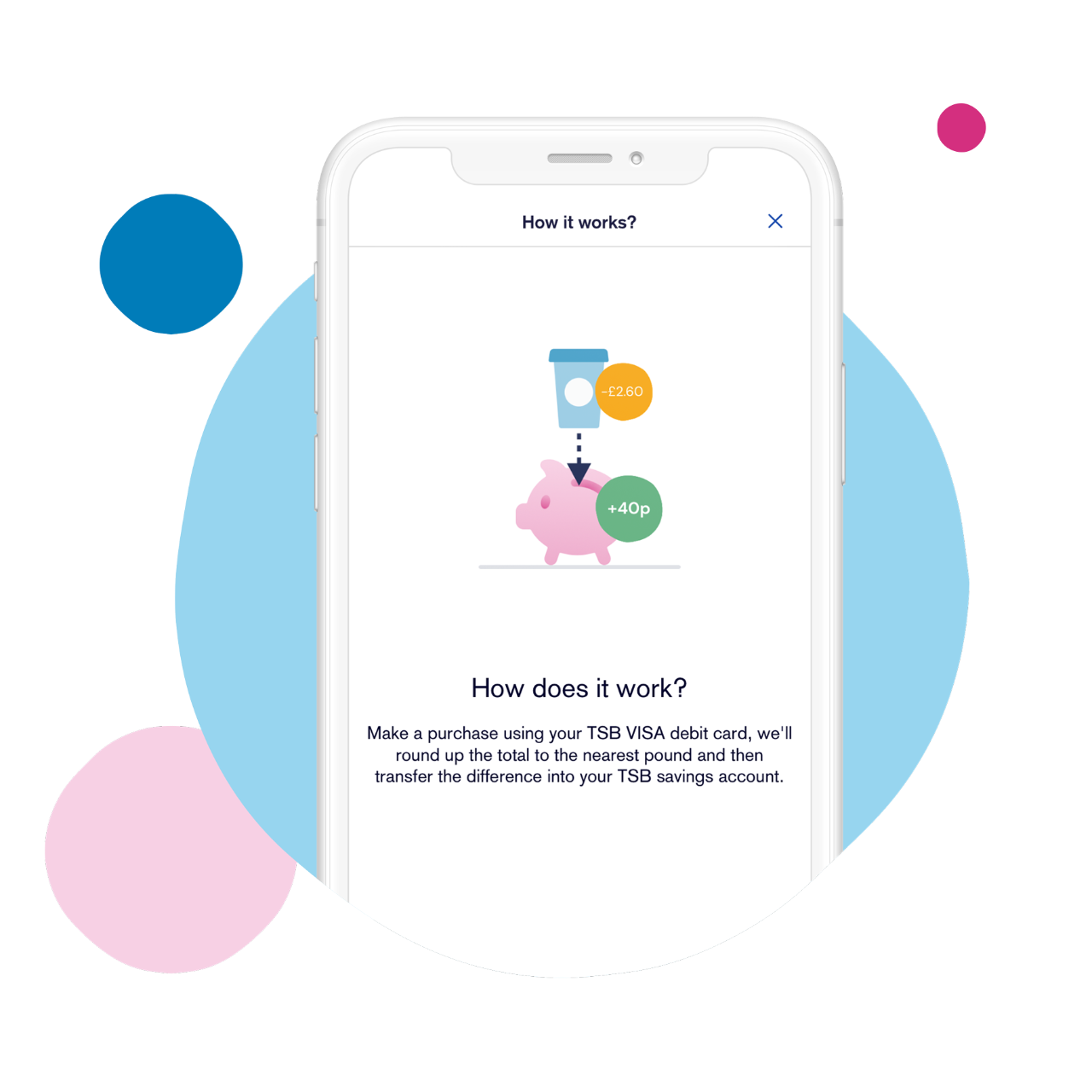

Spend & Save comes with many useful features to help you save. You can set these up in your mobile banking app. Follow the links below to find out more:

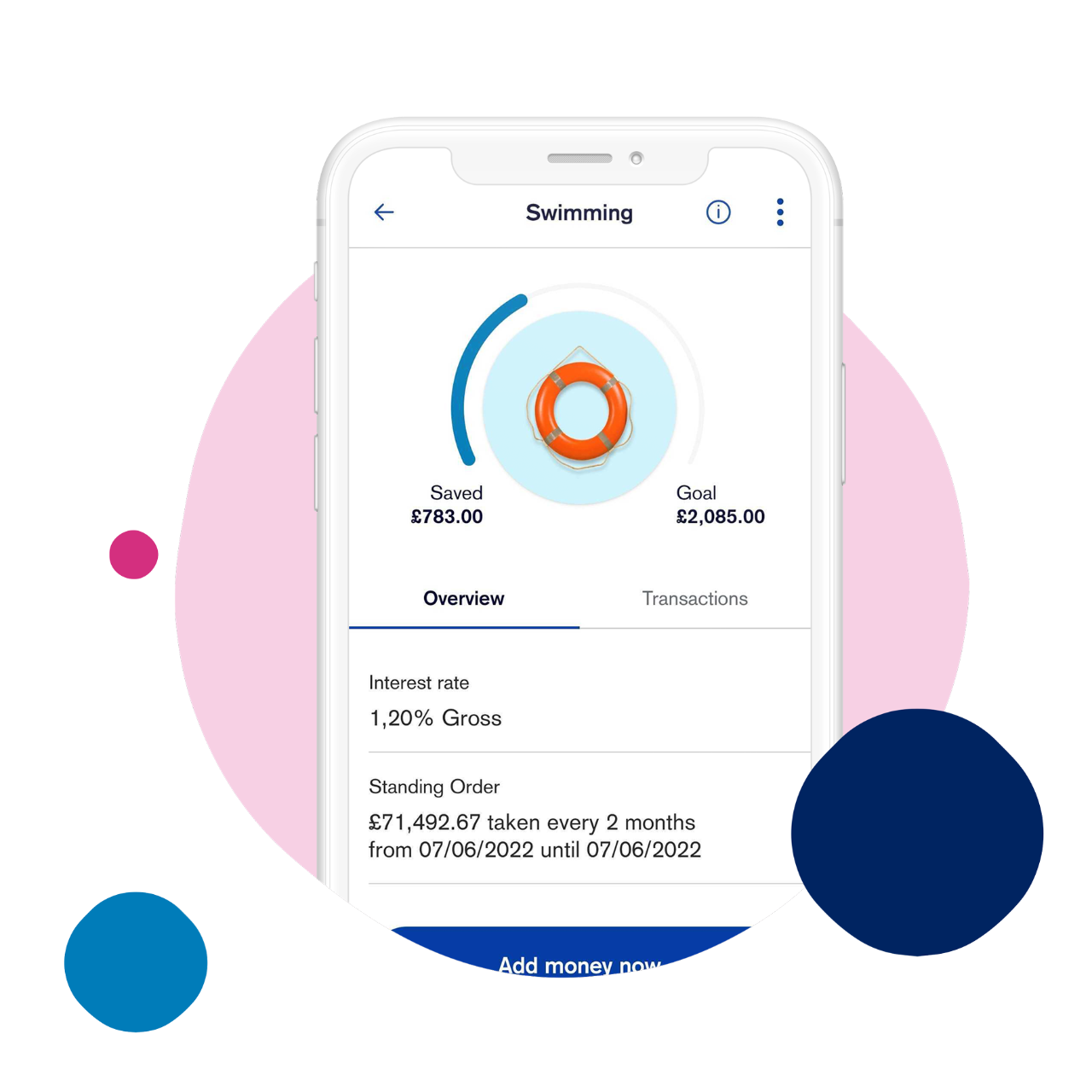

You can have up to five Savings Pots for each Spend & Save or Spend & Save Plus account – one for each of your savings goals.

There is a maximum balance of £5,000 per Savings Pot (£25,000 per Spend & Save or Spend & Save Plus account).

Visit our Savings Pots page to find out more information.

With Spend & Save you can earn £5 Cashback for up to the first six months, including the month you open your account. You just need to make 20 payments or more on your debit card each calendar month.

With Spend & Save Plus you can keep earning £5 cashback each month until you close the account, change to another TSB account or TSB withdraws the offer, as long as you make 20 payments or more on your debit card each calendar month.

To find out more information on how to earn cashback on your Spend & Save, visit our cashback information page.

An arranged overdraft is one that you arrange with us in advance.

To get an arranged overdraft, you must be aged 18 or over and apply online, in a branch or on the telephone. We then run a few affordability checks and, if approved, we let you how much you can borrow.

Once approved, your overdraft will appear on your account immediately for existing customers and in a few days for customers new to TSB.

Visit our overdraft page for more information.

Anything we missed? Find it here

Important information

TSB adheres to The Standards of Lending Practice which are monitored and enforced by the LSB: www.lendingstandardsboard.org.uk.

To read more about our lending commitments to you, please click here to read the leaflet.

Account Opening is subject to our assessment of your circumstances. You must be 18 or over and a UK resident to apply. Interest paid monthly. Overdrafts are subject to application and approval and are repayable on demand. Text alerts are free but your mobile operator may charge for some services. Please check with them. We don’t charge for your use of Mobile Banking but your mobile operator may charge for some services, please check with them. Mobile Banking is available on most internet enabled mobile devices. Services may be affected by phone signal and functionality. You must be registered for Internet Banking. Terms and conditions apply.

*AER (variable) means Annual Equivalent Rate. AER (variable) illustrates what your interest rate would be if interest was paid and compounded each year. Gross rate is the contractual rate of interest payable before the deduction of income tax.