Take advantage of up to £310 in cash and rewards when you switch to one of our Spend & Save bank accounts.

£100 welcome bonus

- Open a Spend & Save account and complete a full switch

- Log into the TSB Mobile Banking App

- Make at least 5 payments using the debit card on your new account

- If you do this before 19 July 2025, we’ll pay you £100 between 2 and 16 August 2025

Up to £90 in cashback

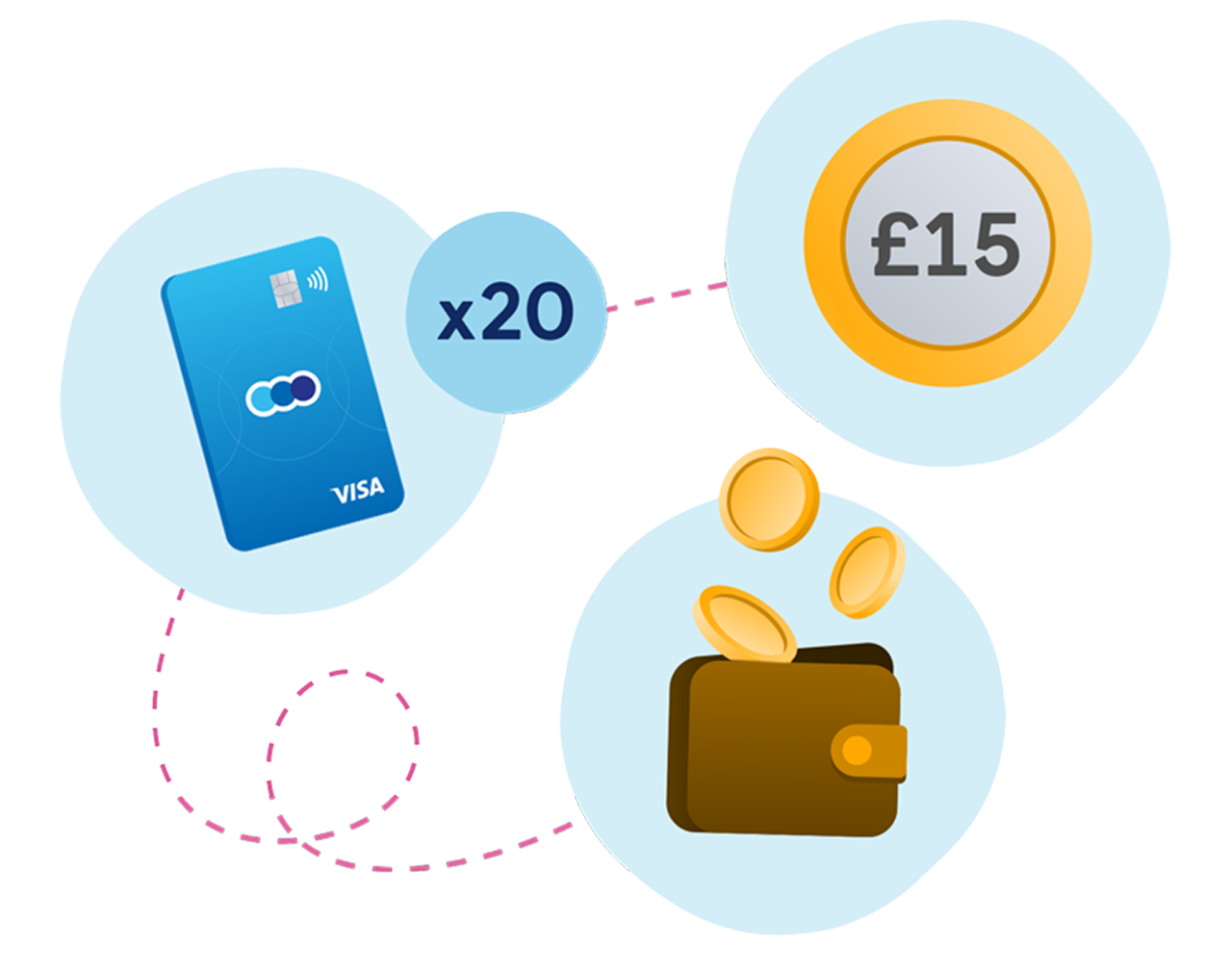

- Earn £15 cashback each month for up to 6 months - that’s triple the amount of cashback we normally offer!

- To qualify for cashback, you’ll need to make 20 or more debit card payments in a calendar month. Pending payments don't count. See how cashback works

- Cashback will be paid into your account the next calendar month

Choose your reward

To choose your reward in January 2026, complete all the steps for the £100 welcome bonus and make 20 or more debit card payments in December 2025.

£120 towards your next hotel stay

Enjoy a £120 voucher that you can use for a hotel stay abroad or a staycation in the UK. T&Cs and exclusions apply.

Access to activity tickets for 12 months

Get tickets for attractions and venues all across the UK, from watersports in Cornwall to museums in the Scottish Highlands. T&Cs and exclusions apply.

Please download and read the full Switch & Stay Terms and Conditions before applying

Step 1:

Open a bank account

- Apply online or download the app to apply

- Start using your account straight away

Step 2:

Complete the online form

- Have your new TSB and old account details handy

- You can find it in ‘Products’ in your TSB app or here

Step 3:

Submit the form

- We’ll complete your switch in 7 working days. Guaranteed

- In the meantime you can still use your old account

With a full switch, we’ll take care of:

- Moving your account balance to the new account.

- Closing your old account. You can still use it up to day 6 of your switch, but any new payments set up during the switch won’t be transferred.

- Copying over the details of everyone you’ve sent payment too (your payees).

- Transferring all your active Direct Debits and standing orders to your TSB account. We’ll also give the sender your new details.

- Redirecting regular income like salary, pension, or benefits payments to your new account.

- Adding a redirect so any payments to your old account automatically go to your new one.

You’ll still need to:

- Transfer any bills or payments that use your debit card details, for example streaming services and subscriptions. You’ll need to update your card details with each provider.

- Move any existing arranged overdrafts. You’ll need to apply for a new arranged overdraft with us (you can do this when you open your new account).

- Change your payment details on Apple Pay or Google Pay. You’ll need to update these yourself within the apps.

- Set up access to your account for any third parties.

Spend & Save

This account offers £5 cashback for six months and smart savings features like Save the Pennies and Savings Pots, plus discounts from big brands with My TSB Rewards.

No monthly fee

Spend & Save Plus

This account offers a £100 interest-free arranged overdraft subject to eligibility, no transaction fees from TSB when you’re abroad, and discounts from big brands with My TSB Rewards. You could even earn cashback.

£3 monthly fee

Start your switch

To switch your current account, you’ll need:

Your new TSB bank sort code and account number

Your old bank sort code and account number

Your old debit card number (if applicable)

Start your switch

Check if you’re eligible for the latest switcher offer

If you’ve received a TSB switching offer since October 2022, you won’t be eligible for this offer.

We use Docusign for this kind of request. Docusign will pass the information you provide to us in a secure manner and won’t process it in any other way. Information on how we use your data can be found in our Data Privacy Notice.

This offer was removed from sale 27 February 2025.

Get £100 bonus for switching, up to £60 in cashback, plus a reward for staying until September 2025.

1 - To qualify for the £100 Switch Incentive you must:

- Apply for a new TSB Spend & Save account or Spend & Save Plus account between 22 January and 27 February 2025

- By 3 March 2025, submit a full switch request via tsb.co.uk or in branch to your new TSB Spend & Save account or Spend & Save Plus account using the Current Account Switch Service

And by 14 March 2025, you need to:

- Log into the TSB Mobile Banking App at least once

- Make a minimum of 5 debit card payments (of any value) using the debit card on your new account

- Once you've done all of this, we'll pay your £100 bonus between 28 March and 11 April 2025.

2 - To earn up to £60 cashback:

- To qualify for cashback, make at least 20 debit card payments each calendar month. We’ll count payments based on when the money is taken from your account, which is usually within 5 working days from the day you make the transaction but can be longer. Check when payments leave your account by looking at your transactions online or your statement.

- If you’ve switched and met the criteria in section 1 above, for the first 6 months we’ll double your cashback to £10 a month, provided you make 20 debit card payments each month.

3 - Choose 1 of 3 rewards:

- Complete section 1 and make 20 debit card payments in August 2025 to choose your reward in September 2025:

- A night away for two at a choice of hotels including Mercure

- 2 ODEON cinema tickets each month for 3 months (6 tickets in total)

- NOW Entertainment Membership for 6 months.

Read the full Switch Terms & Conditions

Any questions?

With Spend & Save you can earn £5 cashback up to the first six months:

- Make 20 payments or more on your debit card each calendar month

- If you open the account towards the end of the month. You’ll still need to make 20 transactions before the end of that same month in order to qualify for the cashback

- Make sure the payments clear before the end of the month as we only count payments based on the date the money is taken from your account

- Payments can take up to 5 days to clear, but sometimes can be longer

- Pending transactions (EG payments that haven’t cleared) don’t count

- Payments that count towards cashback are debit card payments, online payments and mail order purchases, as well as in-store purchases (including contactless, Apple Pay, Google Pay, Samsung Pay)

- ATM withdrawals and Direct Debits don’t count

With Spend & Save Plus you can keep earning £5 cashback each month until you close the account, change to another TSB account or TSB withdraws the offer

You can tell when money is taken from your account by looking at your transactions online or on your statement. Payments that have not cleared in the calendar month will not count

To find out more information on how to earn cashback on your Spend & Save, visit our cashback information page

You can switch your bank account as often as you’d like. However, opening multiple bank accounts or frequently switching your account can lower your credit score.

If you’re already switching your bank account to another provider, you’ll need that switch to complete first. If you try to switch your account while another one is still happening, it could cause delays or issues with your application.

Using the Current Account Switch Service (CASS) online you can switch a current account from another provider to us. Not all banks are participants of CASS. You can check if your current provider is a CASS participant before applying to switch to us here.

If you want to switch from a provider who isn’t a Current Account Switch Service participant, we can still organise the switch but it may take a little longer. Applications to do this are available in a TSB branch. We recommend you book an appointment before visiting the branch. Please call our telephone banking team on 0345 975 8758 to book an appointment.

For Savings switches, please contact the branch. Alternatively ISA switches are available online.

Once your switch is complete, all payments sent to or from your old account will be redirected to your TSB account for at least 3 years. We’ll also contact the sender and give them your new details.

Recurring card payments are not moved as part of the Current Account Switch Service. To change these payments please contact your service provider directly and change your account details with them.

A recurring card payment is a regular payment that's linked directly to your card. Common examples include streaming services and subscriptions. This is different to a Direct Debit or standing order, which is linked directly to your account.

You can switch your joint Current Account from your old bank in to TSB providing that your new TSB Current Account is also a joint account. You can also switch your sole account into a joint account, however you can’t switch a joint account into a sole account.

We may be able to provide facilities to pay off any existing overdraft you may have, subject to our normal lending criteria. If you agree an overdraft limit with us it may not match that offered by your old bank. If you do not come to an agreement with us you will need to make separate arrangements to repay any balance owed with your old bank.

Please be aware your old bank is entitled to use any funds it receives in settlement of the debt on your old account.

Yes, you can still use your old bank account up until day 6 of the switch. If you set up any new payment arrangements on your old bank during the switch these will not be transferred.

Your old bank account will automatically close as part of the 7 day switching process. This ensures payments made to your old account can be redirected to your new account. If your old account is overdrawn or has pending transactions on the day the switch completes the account will stay open until the balance reaches zero.

If you want to keep your old account open you can use the Payment Transfer Service to move any payments you want, to your new account. This can only be done in a TSB branch and will take longer than 7 working days. We recommend you book an appointment before visiting the branch. Please call our Telephone Banking team on 0345 975 8758 to book an appointment.

To cancel the switch completely, you need to let us know at least 7 working days before your switch date. After that, only certain elements can be cancelled depending how far through the process we are.

As part of the 7 day switch there is a redirection on your old bank account. This means credits to your old bank will be forwarded to your new bank within 24 hours. This includes debit card refunds, however, these can take a little longer. If you receive a credit after 3pm Friday, weekends or bank holidays these will be forwarded the next working day.

The Payment Transfer Service lets you manage your account transfer. You tell us which parts of your old account you want to move, including any balance. To use the Payment Transfer Service, please visit one of our branches.

Set up by the government, their independent service is free to use. If the financial firm you've used has gone out of business and can't pay your claim, the FSCS can step in to pay compensation.

Important information

To read more about our lending commitments to you, please click here to read the leaflet.

*AER (variable) means Annual Equivalent Rate. AER (variable) illustrates what your interest rate would be if interest was paid and compounded each year. Gross rate is the contractual rate of interest payable before the deduction of income tax.